Essential Guide to Self Assessment Tax Returns for the Building and Construction Industry

Navigating the world of Self Assessment tax returns can be particularly challenging for those in the building and construction industry. With its unique income streams, varied expenses, and regulatory requirements, understanding how to properly handle your tax affairs is crucial. This guide provides a comprehensive overview of what you need to know to manage your Self Assessment tax returns effectively.

Understanding Self Assessment

Self Assessment is a system used by tax authorities, such as HM Revenue and Customs (HMRC) in the UK, to collect income tax from individuals and businesses who do not have tax automatically deducted from their earnings. For those in the building and construction industry, this typically includes self-employed contractors, subcontractors, and other professionals.

Who Needs to File?

If you’re a sole trader, partner in a business partnership, or a director of a company who also receives income from dividends or has other income not taxed at source, you are required to file a Self Assessment tax return. This applies to a wide range of roles within the construction sector, from builders and electricians to site managers and architects.

Key Components of the Tax Return

Income Reporting: You must report all sources of income, including:

- Payments received for construction work.

- Income from rental properties if applicable.

- Any additional earnings from freelance or consulting work.

Claiming Expenses: Accurate record-keeping is essential for claiming allowable expenses. Common deductions in the construction industry include:

- Tools and equipment costs.

- Materials purchased for specific projects.

- Travel expenses between sites.

- Professional fees, such as those for accountants or consultants.

- Safety equipment and uniforms.

Keep detailed records and receipts for all expenses to ensure they are substantiated and can be claimed.

Calculating Taxable Income: Deduct your allowable expenses from your total income to determine your taxable income. Apply the relevant tax rates to calculate the amount of tax you owe.

Key Considerations

- VAT: If your annual turnover exceeds the VAT threshold, you’ll need to register for VAT and submit VAT returns. Ensure you understand how VAT affects your income and expenses, as it can impact your overall tax liability.

- IR35 Regulations: For contractors working through intermediaries (e.g., limited companies), IR35 regulations may apply. This set of rules determines whether you are operating as a genuine contractor or if your arrangement resembles employment, affecting your tax status.

- Penalties for Late Filing: Missing deadlines for submitting your Self Assessment tax return or paying your tax can result in significant penalties and interest charges. Ensure you are aware of key dates and file your return promptly.

Helpful Tips

- Maintain Detailed Records: Accurate and comprehensive record-keeping is critical. Utilize accounting software or consult a professional to ensure you are capturing all necessary details.

- Seek Professional Advice: Tax regulations can be complex, and the building and construction industry has specific nuances. Engaging a tax advisor or accountant with experience in this sector can help you navigate your obligations and maximize your allowable deductions.

- Stay Informed: Tax rules and regulations can change. Keep up-to-date with any modifications that may affect your Self Assessment tax return by regularly checking HMRC updates or consulting with a tax professional.

Conclusion

Handling Self Assessment tax returns in the building and construction industry requires careful planning and attention to detail. By understanding your reporting requirements, accurately claiming expenses, and staying informed about relevant regulations, you can manage your tax responsibilities effectively and avoid common pitfalls. For many, working with a qualified accountant can be a valuable investment to ensure compliance and optimize tax outcomes.

Featured articles and news

Twas the site before Christmas...

A rhyme for the industry and a thankyou to our supporters.

Plumbing and heating systems in schools

New apprentice pay rates coming into effect in the new year

Addressing the impact of recent national minimum wage changes.

EBSSA support for the new industry competence structure

The Engineering and Building Services Skills Authority, in working group 2.

Notes from BSRIA Sustainable Futures briefing

From carbon down to the all important customer: Redefining Retrofit for Net Zero Living.

Principal Designer: A New Opportunity for Architects

ACA launches a Principal Designer Register for architects.

A new government plan for housing and nature recovery

Exploring a new housing and infrastructure nature recovery framework.

Leveraging technology to enhance prospects for students

A case study on the significance of the Autodesk Revit certification.

Fundamental Review of Building Regulations Guidance

Announced during commons debate on the Grenfell Inquiry Phase 2 report.

CIAT responds to the updated National Planning Policy Framework

With key changes in the revised NPPF outlined.

Councils and communities highlighted for delivery of common-sense housing in planning overhaul

As government follows up with mandatory housing targets.

CIOB photographic competition final images revealed

Art of Building produces stunning images for another year.

HSE prosecutes company for putting workers at risk

Roofing company fined and its director sentenced.

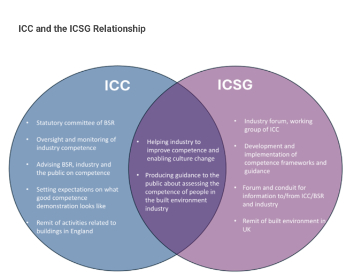

Strategic restructure to transform industry competence

EBSSA becomes part of a new industry competence structure.

Major overhaul of planning committees proposed by government

Planning decisions set to be fast-tracked to tackle the housing crisis.

Industry Competence Steering Group restructure

ICSG transitions to the Industry Competence Committee (ICC) under the Building Safety Regulator (BSR).

Principal Contractor Competency Certification Scheme

CIOB PCCCS competence framework for Principal Contractors.

The CIAT Principal Designer register

Issues explained via a series of FAQs.